** Background **

I participated on a two day design challenge about AI driven software development.

** Brief **

You are working for a large consumer bank. The bank is concerned about possible money laundering activities taking place via it's services and wants to develop a system that helps them detect fraud.

The bank wants to use a combination of AI and fraud specialists (people) for this job. The AI part is handled by a Machine Learning team that will build a system to analyse transactions and flag them as possibly fraudulent.

A new system that has yet to be built will present these flagged transactions to fraud specialists. Additionally, the fraud specialists will use the new system to dig around in the data to manually detect fraud.

** RESEARCH GOALS **

Understand the field, workflows

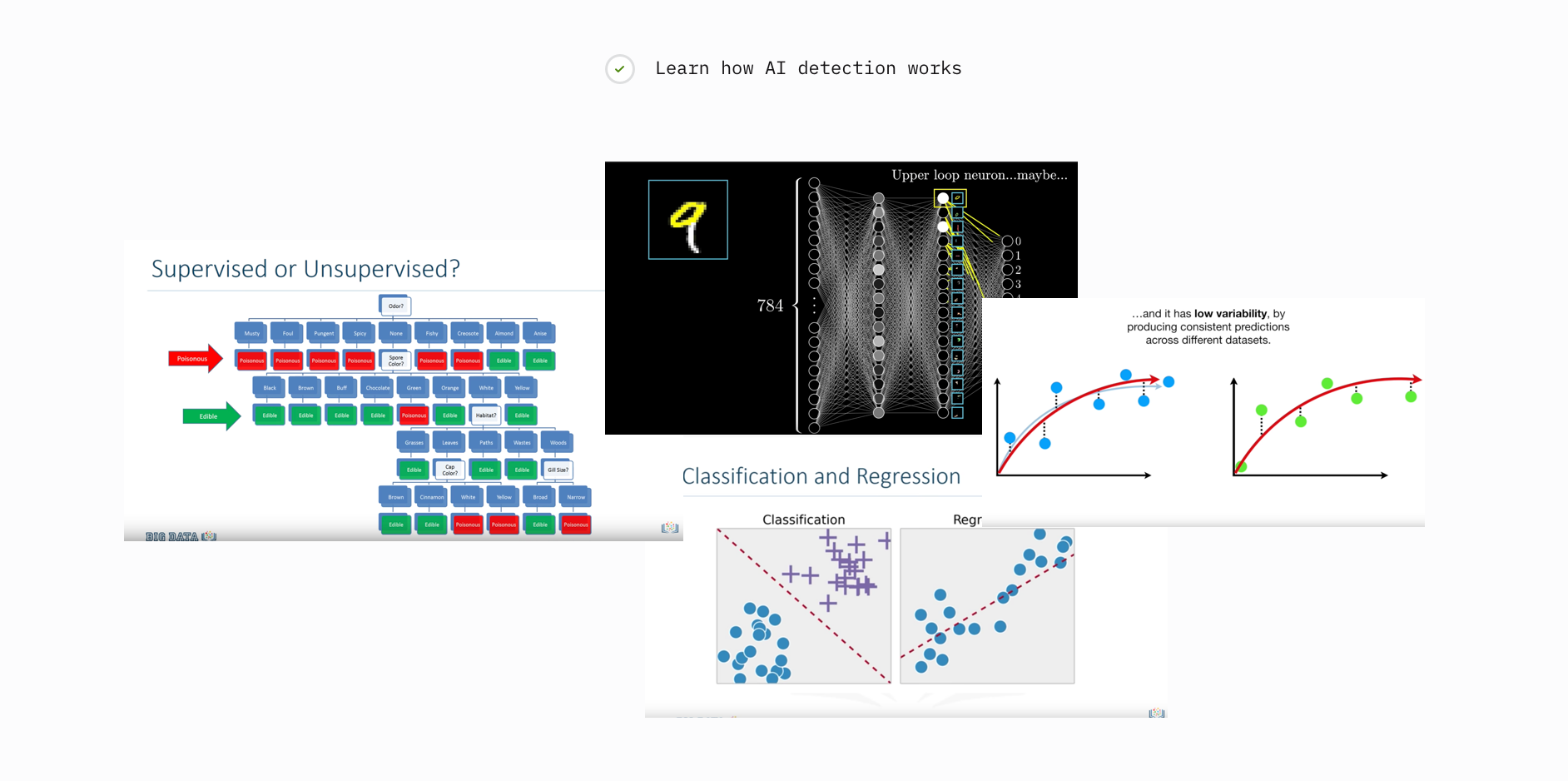

Learn how AI detection works

Reviewing already existing solutions

To understand the field I immersed myself in a range of topics centred around fraud detections and large-volume data analysis.

** Takeaways **

Financial fraud experts work with large datasets with lots of parameters

The data is highly unbalanced, meaning there are a lot more transactions than fraud instances

Important variables: chargebacks, round number items, credit score, declined items, foreign transactions

** Learning about AI Detection **

Learning about supervised/unsupervised machine learning, neural networks and classification.

** Takeaways **

A modern AI would need a combination of supervised pattern recognition and unsupervised outlier detection. These two systems would run side-by-side. On top of this system a neural network could learn from these signals and recommend potential fraud cases. The output of the AI is considered a black box as it only gives you a probability score, so it’s important to make it understandable.

The imagined system for detecting fraud

** Competitor Analysis **

To understand the field and currently existing solutions I took a look at commercially available solutions on the market. Although they were created for e-commerce in mind they could serve as a good starting point.

** Understanding the Context **

To summarise my findings from the research phase I defined the context, user needs and pain points.

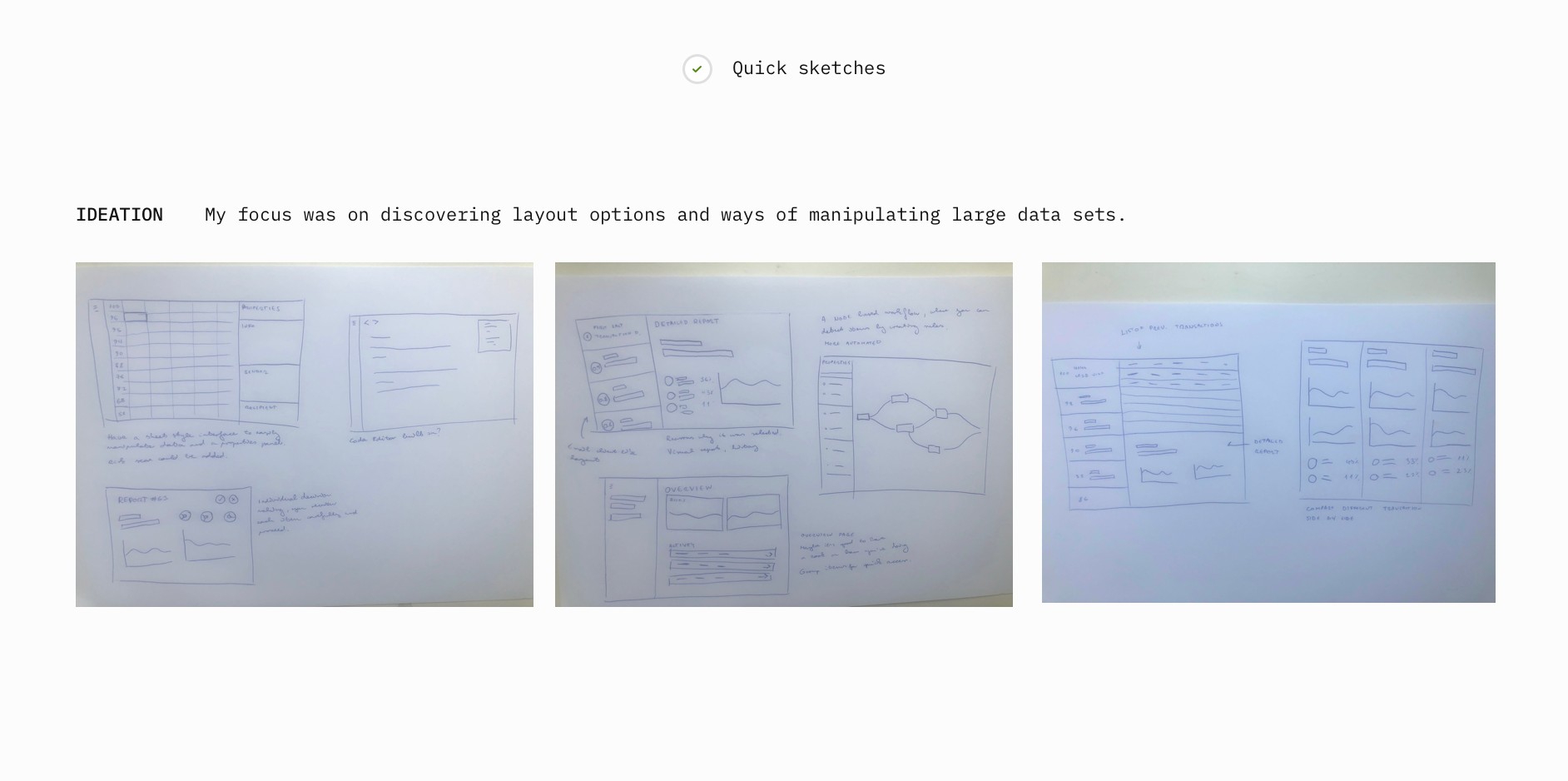

** IDEATION GOALS **

Look at professional tools, best practices

Create layouts, a sitemap

Refine details, IA

** Professional Tools **

To gather best practices and requirement for a professional tool I looked at several examples on the market. Cinema 4D and BlackMagic Fusion stood out with it’s handling of the complex source material and detachable, configurable panels. I’ve looked at Google Sheets as the fraud detection software will be used by people with an office skillset an spreadsheets are an ideal solution for handling large amounts of data.

** Takeaways **

Flexibility and consistency is key. One of the best examples is Cinema 4D where panels can removed, rearranged or ‘popped out’. The same controls are used everywhere so you always know what to expect.Another great example for flexibility are spreadsheet software where you can write equations and manipulate rows and columns however you want to.

** Creating layouts **

** The Approach **

I chose to go with a spreadsheet style layout because it gives flexibility to arrange items and write custom equations. It can be used after a bit of training and you’re not limited to looking at individual items but can see things in context which can be useful for spotting large scale fraud.

You would also need a detail view after selecting a row to get more information and a dashboard view to track your progress and see highlighted elements and history.

** Information Architecture **

** Design Goals **

Find good references

Find a readable font

Prepare designs

** Finding References **

** Font Selection **

** Designs **

The list of threats identified by the AI are ordered based on their risk score. The bank employee can write custom equations to compare them or click on one to see more details.

The documentation for the tool is built into the menu structure to reduce training time.

The dashboard view serves as an overview of the employee performance and allows him/her to check recent items and reach out to team members.

** What I’ve Learned **

Fraud detection is a super exciting field and the currently existing solutions still feel lacking.

There’s a huge market out there to make it simpler and more efficient and more automated.

Information on the topic was scarce, products are kept in silos and without access to someone in the field I had to rely on the internet as my guide.

** If I had more time **

Observe fraud teams in action (ethnographic research)

Understand the recommendation engine in detail

Create lots of ideas and potential approaches, user roles